AI now drives product discovery for millions of Americans

A new study shows AI and social platforms are driving record traffic to online stores—but 80% of shoppers still abandon their carts

Online retail is experiencing rapid traffic growth, yet most shopping journeys end without a purchase.

To understand why, Semrush and Statista analyzed millions of shopping sessions across major e-commerce platforms.

Their report, “Rewriting the E-commerce Playbook: Artificial Intelligence, Social Commerce, and the Future of Consumer Confidence,” reveals that while AI assistants and social commerce platforms are changing how Americans discover products, friction at checkout keeps customers from making a final purchase.

The findings point to three major shifts in online retail: the rise of conversational search, the growth of social shopping, and the checkout obstacles that cost retailers billions.

Instead of searching, Americans now ask AI for product recommendations

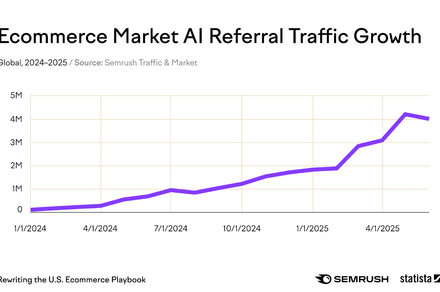

The report reveals the most dramatic change in online retail is how Americans find products. Monthly visits to shopping websites from AI assistants increased by a staggering 3,900% – from around 100,000 visits in January 2024 to over 4 million by June 2025.

Social commerce will hit $140 Billion by 2028

Social platforms have become major retail destinations. Commerce across TikTok, Instagram, and Facebook are projected to reach $140 billion by 2028.

The generational split in behavior among social shoppers is dramatic, however.

On TikTok shop, Generation Z is the most active generation. 87% of this age group visit the Shop at least monthly, and almost 25% visit the Shop daily. Only 23% of Boomers, on the other hand, visit monthly: Their daily use is just 6%.

This gap might be that older Americans remain skeptical of social shopping. Gen X emerges as the most wary of making purchases on social media platforms, with 55% of this generation stating they don’t trust spending money on TikTok.

Fast delivery infrastructure widens the urban-rural shopping gap

The report shows a growing gap between urban and rural online shopping. From 2024 to 2025, urban states increased their online shopping, while rural areas saw declines.

New York led the nation with a 7.6% increase in online shopping activity, followed by other urban regions like Maryland (5.6%), California (5.5%), New Jersey (5.4%), and Georgia (5.2%). Meanwhile, rural states like Montana (-6.8%), Alaska (-6.2%), and New Mexico (-5.1%) showed significant drops in online purchases.

The split comes down to infrastructure basics. Urban shoppers get same-day delivery, plenty of pickup spots, and fast internet that make online buying smooth and convenient. Rural shoppers, however, face slow shipping, high delivery fees, and spotty broadband that turn online shopping into a frustrating experience.

Eight in ten shoppers abandon their shopping carts

While AI assistants and social shopping have changed how people discover products, they haven’t solved online retail’s biggest headache: cart abandonment.

This report reveals that 8 out of 10 shoppers still abandon their carts before making a purchase. Top reasons for leaving a cart include:

- High surprise fees (39%). When shoppers find unexpected shipping charges and taxes at checkout, good deals suddenly become deceptively expensive purchases.

- Slow delivery (21%). Americans expect fast shipping and abandon orders when delivery times feel too long.

- Required account creation (19%). Many shoppers won’t create accounts just to buy something, especially from unfamiliar stores.

- Security concerns (19%). Customers hesitate to enter credit card information on websites they don’t trust.

What retailers must do to compete

Retailers can adapt to these shifts by focusing on three operational priorities.

First, they must make their website product information easy for AI tools to find and recommend. Clear descriptions and transparent pricing up front will help AI assistants and prevent surprise fees for customers at checkout.

Second, retailers must post regularly to the social platforms where their customers discover products. For those with younger shoppers, that means TikTok and Instagram with shoppable posts and creator partnerships. Retailers with older followers should post more product-focused content on Facebook.

Third, online retailers must compete on delivery speed in urban markets and transparency in rural ones. Urban shoppers expect same-day or next-day options. Rural shoppers accept longer timelines but need precise delivery estimates.

Companies that incorporate all three tactics will be better positioned to capture more of the changing U.S retail market.

Based on “Rewriting the Ecommerce Playbook: Artificial Intelligence, Social Commerce, and the Future of Consumer Confidence,” a comprehensive analysis by Semrush and Statista of U.S. ecommerce trends and consumer behavior.

Digital Trends partners with external contributors. All contributor content is reviewed by the Digital Trends editorial staff.