The tech market is fundamentally fucked up and AI is just a scapegoat

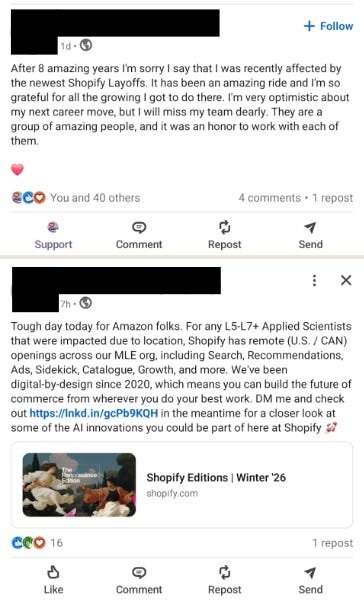

Writing about layoffs and the tech market has been on my TODO for several years. Yesterday, the news of 16k Amazon layoffs plus two LinkedIn posts on the same topic back-to-back encouraged me to finally write about it.

Disclaimer: I worked 5 years at Shopify. This is probably why such posts come one after another on my feed but Shopify isn’t the point here, they are just a micro piece of the whole fucked up system.

Tech job market is fundamentally broken and we all pointing fingers at AI.

But having spent almost 2 decades in the industry, I think the rot goes much deeper than ChatGPT.

Truth to be told tech market hasn’t truly ‘improved’ since the 2008 financial crisis. It just mutated into something evil.

After the 2008 mortgage crisis, the economic regime significantly changed. Which was also around the time my interest in Finance began and recently I started to build my own investment tool you can read more about it here.

At that time time we entered an era of extensive liquidity (cheap money). When interest rates are near zero, investors demand growth above all else.

As a result, tech companies stopped building for sustainability and started building for exponential expansion.

Here is a graph shows US Fed Interest Rates by years.

Ref: https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

In traditional industries like manufacturing you don’t hire 500 factory workers unless you have a production line that needs them. You don’t over-hire based on a guess.

But in Tech, the playbook is different. Companies over-hire software engineers intentionally. To play the lottery. It is similar to having slow and steady ETF investments vs active investing. No matter how godly you are with active investing sooner or later, you will invest on a loser. Same goes for businesses.

In a factory, “Work in Progress” (unfinished goods) is a liability. You don’t want inventory sitting on the floor; you want it out the door.

In software, we convinced ourselves that “Work in Progress” (hiring engineers to work on projects that haven’t shipped yet) is an asset.

It is not. It is just excessive inventory.

When the market turned, companies realized they were warehousing talent like unsold products. And just like unsold inventory, when the storage costs get too high, you dump it.

Layoffs have become a product feature.

Till ~2010, a layoff was a sign of failure. It meant the CEO messed up.

In 2024, a layoff is a signal of “discipline.” Companies lay off thousands, and their stock price jumps.

They are signaling to Wall Street that they are willing to sacrifice human capital to protect margins.

Big Tech companies (think Google, Meta, or any hyper-growth SaaS) operate on a two-tier system:

1. The Core: A fundamental team working on the actual revenue-generating products (the search engine, the ad network, the checkout flow).

2. The Bets: Thousands of engineers hired to build parallel products, experimental features, or simply to keep talent away from competitors and potentially build something that would move into “The Core” tier.

The company knows that most of these side bets will fail. When the economic winds change, the ‘non-core’ staff becomes immediately replaceable.

It’s a vicious cycle: Hire the best people you can find to hoard talent, see what sticks, and lay off the rest when investors want to see better margins.

This dynamic creates a cruel paradox for engineers.

Most engineers (including me) spent months grinding LeetCode at least twice in their career, studying system design, and passing grueling 6-round interviews to prove they are the “top 1%.”

Yet, once hired, they are often placed on a non-essential team where they become nothing more than a statistic on a spreadsheet.

You jump through hoops to prove you are exceptional, only to be treated as disposable.

For a long time, Europe offered a counter-balance. The pay was lower than Silicon Valley, but the trade-off was stability, stronger labor protections, and a slower, more sustainable pace of work.

That social contract is breaking.

As American tech giants expanded into Europe and as European unicorns chased the same growth-at-all-costs playbooks the incentives changed.

Leadership imported US-style compensation models, investor expectations, and organizational volatility, but without importing US-level pay or upside.

”On paper” Europe still has strong labor laws. In practice, companies learned to route around them: constant reorganizations, “strategic refocus” layoffs, performance-managed exits.

The result is the worst of both worlds. European engineers now face US-level job insecurity with European-level compensation and limited mobility. The safety net hasn’t disappeared, but it’s being slowly hollowed out.

And severances… A small, one-time payment is used to justify years of below market compensation, while offering little real protection against sudden displacement.

Europe just became a lower-cost extension of Silicon Valley.

Ultimately, this comes down to how companies signal value.

Traditional businesses used to show their health through revenue, profit, and smart capital investment. Today, Tech companies use layoffs as a marketing signal to Wall Street. They cut costs not because they are going bankrupt, but to show they can be “efficient.”

The more liquidity that was pumped into Tech, the harder this situation became. As long as engineers are treated as speculative assets rather than human capital, the market will remain broken regardless of how good AI gets.

The job market is not “tough” right now because of AI. It is tough because we are unwinding 14 years of financial toxicity.

The liquidity that flooded the tech sector didn’t just inflate valuations; it inflated teams, egos, and expectations.

Until the industry relearns how to build with scarcity rather than excess, the “vicious cycle” of hire-and-dump will continue regardless of how good AI will get.

So you aren’t being laid off because your performance was bad; you are being effectively “liquidated” like a bad stock trade that you sell with a loss.