Ubisoft’s restructure plan spooks the markets, and it’s not hard to see why | Opinion

Everyone wants to see the French publisher stem the bleeding – but this latest plan looks more like rearranging parts on a chopping block than a real attempt at reform

It’s fair to say that it’s been a rough decade for European publishers. The last bastion of Britain’s long-established publishing houses, Codemasters, was bought by EA in 2021. A couple of years later, one of the continent’s largest publishers, Sweden’s Embracer Group, hit the financial skids and was forced to divest or shut down many of the studios it had bought in a spending spree over the prior years.

While some smaller European publishers such as the indie-focused Kepler, or self-publishers like CD Projekt Red, have quietly been doing pretty well, things have generally seemed grim. That’s in part because of the buyouts of stalwarts like Codemasters; in part because the implosion of Embracer hurt so many other companies all over the continent; and in part because all of this was taking place under the looming shadow of Ubisoft’s decline.

With the likes of Eidos and Infogrames long gone, and in spite of Embracer’s attempt to scale through an incredibly rapid and poorly conceived acquisition spree, Ubisoft is now the European publisher. It’s the continent’s last independent giant; its success and continued international relevance as much a point of pride as of economic importance.

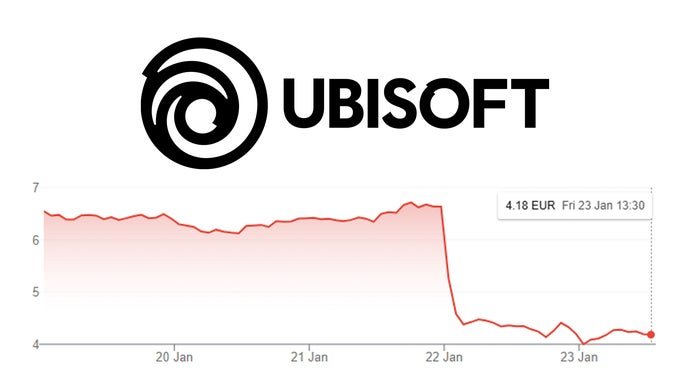

Yet “troubled” doesn’t begin to describe Ubisoft’s situation this decade. Its share price is down 95% from its peak. Its financial results have disappointed over and over again, with several key titles underperforming – the weak performance of Star Wars Outlaws recently being an especially damaging blow. Thousands of staff have been laid off in a series of cuts and studio closures.

This week, Ubisoft unveiled what is meant to be the reorganisation that will fix its problems and halt its decline. Building on a major deal with Tencent that was announced late last year, the company is going to reorganise all its studios and IPs into five business units (“creative houses”) which will have a strong degree of financial independence and creative control over their assigned genres.

On paper, you can see the argument for why this would work. The core of Ubisoft’s problem – like with most corporate problems – is some disastrously bad management decision-making compounded, by many accounts, by a kind of internal politics and fiefdom-building which rarely if ever lends itself to sound business choices. Projects languished in development hell for endless years, gorging on resources and delivering nothing but red ink and sunk cost fallacies.

Splitting the company into silos could, in theory, focus minds on clearer goals by putting financial responsibilities and rewards in closer proximity to creative decision-making. If the problem was top-down, then this could be a solution – again, in theory.

The markets, it’s fair to say, aren’t convinced. Ubisoft’s shares tumbled another 40% yesterday after the restructuring was announced, though this seems a little more dramatic than the reality; 40% of an already devastated share price isn’t as much as it sounds.

“To a cynical eye it starts to look less like a recovery plan and more like slicing and dicing the company for further divestments”

We can only speculate as to what spooks investors about this restructuring, but one likely culprit is the fact that if you tilt your head and look at it from a different angle, to a cynical eye it starts to look less like a recovery plan and more like slicing and dicing the company for further divestments and downsizing.

In line with Ubisoft’s deal with Tencent last year, the first of the new “creative houses” holds all of the company’s flagship titles – Assassin’s Creed, Far Cry, and Rainbow Six – with the Chinese giant taking a stake in this subsidiary at a valuation massively higher than Ubisoft’s current market capitalisation.

The rest of the creative houses are arranged by “genre”, to at least some degree; CH2 holds shooters, CH3 holds live service games, CH4 is adventure and fantasy games, and CH5 is family and mobile titles. The problem, of course, is that creating a single unit that holds all the flagships robs each of those units of what should be their flagpole games right from the outset. What is Ubisoft’s adventure and fantasy unit without Assassin’s Creed? What is its shooter unit without Far Cry or Rainbow Six?

What they are, or at least what they look like, is easy fodder for the chopping block next time a round of swingeing cuts is called for. This is the most cynical possible take, for sure, but this does look awfully like a company that’s reorganised the crown jewels – the titles investors are genuinely interested in – into one business unit, as a prelude to throwing the rest out to fend for itself.

It would be wonderful to be wrong about that sense – a strong, thriving Ubisoft at the heart of Europe’s games industry would be a positive for everyone involved – but the feeling that this reorganisation is far from a panacea for the publisher’s ills doesn’t just stem from the oddness of lumping all the successful titles into one unit.

For one thing, it’s also quite unclear how well insulated the new business units will actually be from the top-down meddling that’s often been nodded to as a part of Ubisoft’s malaise over the years. The announcement is big on the idea of each creative house being filled with genre expertise and given full ownership of finances, but the devil of such things is always in the detail.

Ubisoft wouldn’t be the first company to create organisational silos and then force them to spend much of their energy fighting off interventions from upper management. Given the absolutely tenacious way in which Yves Guillemot has protected his control of the company from outside investors and hostile takeovers over the years, it’s fair to question how much of it he’d really be willing to surrender it to his own subordinates.

Moreover, the seeds of that kind of suffocating top-down decision making are already there from the start, in the form of an expectation that all staff return to full in-office work. Never mind that this is the kind of posturing, puffed-chest bollocks that competent managers and companies with actual good ideas for sorting out their problems don’t have to resort to. It’s also exactly the kind of decision you might reasonably expect newly empowered, independent creative houses to be able to make on their own based on their best assessment of their workforces’ needs and performance – not to be imposed top-down by executives and consultants.

Sadly, the market response to Ubisoft’s big reorganisation is probably justified. The company’s top management isn’t changing – Guillemot has made it clear that he’ll Thelma and Louise this thing off a cliff rather than relinquishing his grip on the wheel. Its penchant for top-down control seems likely to survive any lip service paid to independent business units. The new structure looks more like a butchers’ menu for private equity than a recipe for future success.

The warning that the restructuring will come with yet more job losses underscores the reality here. You can pay expensive consultants to make Powerpoint slides with the word “efficiency” on them in as many different layouts as you like, but a games company that’s still firing people who make games is a games company that’s still bleeding in the present, not building for the future.